This post may contain affiliate links. Please read my disclosure policy for more info

As humans, each and every one of us has our own beliefs, why we believe them and how those beliefs directly or indirectly affect our everyday life.

Although we have the right to believe in whatever we want, that does not make each and every belief right. In other words, our beliefs can only either be positive or negative. Of course, sometimes we might not even recognize that we hold a certain belief. We simply see it as being true in our lives, not as something we’re choosing to believe.

Your Money Mindset

If your perception of money or your attitude towards it doesn’t enhance or encourage your ability to attract more money, then maybe you want to change your mindset surrounding money. Do you know why I am sure about your need to change this retrogressive mindset towards money? It is because I know that nobody enjoys living in abject poverty. Yep, no matter how humble or modest you are, nobody wants to suffer to have even the basic necessities of life.

Moreover, since you are reading this article, it is probably because you have a lot of unanswered questions in your head.

You have probably seen a lot of people living their lives to the fullest, acquiring whatever they need or want, buying cars and mansions. And this might make you wonder if you can ever have such achievements, if you will ever get to enjoy such financial buoyancy!

You begin to ask yourself questions like: Do I have what it takes to make money? Do I have the right mindset? How best can I change my perception of money? How can I make more money through my change of mindset? Can I ever be financially free?

It is not a surprise at all because those are very popular questions and virtually everybody, both rich and poor, has asked (or still asks) some of those questions, so don’t ever feel like you’re alone in this. Maybe you don’t even do this consciously, you just believe that it’s something you’ll never have.

Below I’ll go into giving you some practical tips on the ways to transform your money mindset in order to have a more abundant money mindset.

Psst – If you’re really SERIOUS about transforming your money mindset – meditation and the proper affirmations can go a long way towards helping you achieve this. There’s a program called Overnight Millionaire which I highly recommend. It helps you reprogram your brain from scarcity to abundance and helps you manifest more wealth into your life. But only if you let it and actually do the required work. Check it out if you’re interested.

1. Learn to fall in love with money

There are many misconceptions about money, especially from the religious point of view. And above all misconceptions of money, there is this popular quote that “The love of money is the root of all evil” or simply “Money is the root of all evil”. This is not true. Money is neutral. It is just a tool. But having this negative belief can also negatively influence your relationship with money.

If you don’t have the right money mindset, or you have a negative relationship with money, then you won’t love your money. Consequently, you could find yourself always thinking money is scarce and hard to come by. Always thinking it is difficult just to get money. But with the right mindset, your love for money can only drive you towards doing meaningful things to acquire more wealth.

Money is simply a tool used in a transaction. You get money in exchange for value. Or you spend money in exchange for value. Some people believe that time is money. That you should exchange your time for money. Work 40 hours a week for a certain amount of money.

But really, what you’re getting paid for is the amount of value you deliver by working those 40 hours a week. Think about it this way: When you pay for your new iPhone (or any phone), you don’t ask the salesperson how long it took to create the iPhone. No, you just care about the features of the phone, the amount of value it provides.

So stop treating your money with disrespect. Stop talking bad about your money.

If money is this relevant, why not fall in love with it? Let me ask again, where is that man who rejects a fine loaf of bread and opts for a stone instead? I don’t think he exists. Loving money itself is not bad but using money the wrong way is the really bad thing. Always be guided.

The key question now is not if you should love money, because as long as you want to attract more money, you must love money! The question now is why is it important to love money?

The answer to this question is straightforward: if you don’t love money, you won’t chase money, no one chases what he doesn’t love or admire. And if you don’t chase money, how then can you make money?

2. Learn to associate only with those with the right mindset

A popular quote that can be traced back to a wise man that lived over 2000 years ago says: “Show me your friends and I will tell you who you are.” What this means is that there is a strong relationship between your reality and those who you are closely associated with. This is similar to peer influence, but just in the positive direction.

It’s no longer news that most of the evils perpetrated in the society today are as a result of bad peer influence. On the other hand, this same peer influence can be channeled towards a positive direction. Your friends, close allies and associates can be the driving force you need to transform your money mindset.

However, transformation through peer influence does not just happen, it’s a gradual process of intentional change that happens as a result of socialization. So associate with people who don’t have a scarcity mentality but rather one of abundance. There is enough money for everyone, and making money doesn’t mean you are taking it away from someone else. It’s time to do away with those false beliefs!.

3. Handle money with care

Money reacts just like humans—depending on how you treat it. Actually, nobody wants to be treated unfairly, and also, nobody wants to be taken for granted. People tend to move away when they have a nasty experience around you. The same thing is applicable to money.

When you disregard the true value of money and waste it, when you don’t nurture your money by saving it and investing it wisely, there is every tendency that money will run away from you. Such a bitter experience will only mar, rather than build your mindset when it comes to money and how to handle it.

4. Learn from your past and become future-oriented

Another vital agent of transformation is to learn from your bitter experiences. Don’t dwell on your failures, learn to move on. It’s one thing to fall but another thing to rise up. And there is no better way to rise than to use your past mistake as an advantage to target future success, knowing fully well that you are better prepared than before.

Someone who hasn’t tasted failure before can’t be regarded as a fully experienced person because failure is part of the prerequisites (in terms of experience) to achieve success.

When you finally decide to be future-oriented, one of your key advantages is that based on your previous experience, you now know what to expect and how to tackle any issue without repeating your initial mistakes.

One good way to focus on the future is by creating a blueprint, i.e. a detailed plan on what you intend to achieve within a given period of time. Then in order to achieve the plan, you also have to establish a budget and strictly work towards implementing it. By doing this, there is no way your worldview will remain the same… There will definitely be some sort of transformation.

5. The “Why” and “How” questions are important for you

It won’t be far-fetched to say that questioning is one of the major ways through which so much knowledge is acquired. The answers you get through asking the right questions could be all you need in order to acquire the financial freedom you crave for.

I’m sure you may already be asking yourself “What are these right questions?” The best questions that bring about the desired change are the Why and How questions.

It’s pertinent for you to ask questions like: Why am I financially unstable? Why am I not making enough money? Why do I find it difficult to save? The answer to these questions is probably because you don’t have the right money mindset. So what next?

Now listen, you don’t stop at asking “why,” you also need to get the solution by asking “how.” How can I transform my financial situation? And how can I make more money? How do I start saving up enough?

Use these questions to develop a plan for your financial future and start taking action.

6. Don’t stay indebted to anyone!

If you usually owe people, I’m sure you already know how it feels when you surpass the stipulated time frame for repayment.

One of the most discomforting things about being a debtor is that you feel like you are in a cage. In other words, you don’t fully own yourself because you live at the mercy of your creditor or lender. Is that what you really want for yourself? Nope, I think not.

Moreover, it’s easier to borrow but it’s always hard to pay back. Just imagine that you earn $800 per month but before you receive your salary, you already have a debt of $600 to repay to your lender! How then can you save or invest in order to grow financially?

Do you really want to keep repeating the cycle or do you want to break out and be free?

The simplest way to break free from debt, whether bank loan or mortgage, is to learn to live a little bit below your actual income. Don’t save the remainder of what is left after spending, rather, you should first of all, remove a portion of what you intend to save, then manage the remainder for spending. It’s not easy, but it’s doable.

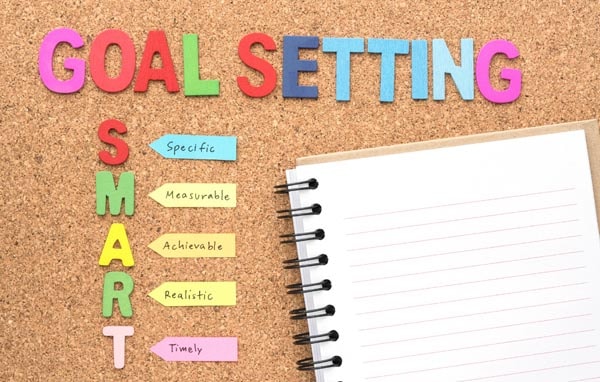

7. It’s important that you set a goal

Benjamin Mays has a popular statement attributed to him… He posited that the tragedy of life does not lie in your ability not to achieve your goal, rather, the real tragedy is when you have no goal at all!

It’s indeed very important to set a goal if you really want to move forward. Setting a goal gives you a sense of direction. When you have a goal, you have something that you are looking forward to, something that you are chasing.

No one can claim he has a positive money mindset if he has no goal. Because having no goal is a negativity in itself. How much money do you want to earn? What do you want your lifestyle to be like? What can you do now to take a step towards achieving it?

8. Celebrate your little successes, feel accomplished

Learn never to underrate your little successes. That little goal that you set and easily achieved is not a small deal. Start valuing your accomplishments, no matter how little they are. The sense of accomplishment that you derived from achieving that little goal will motivate you to set a bigger one.

Gradually but steadily, you will get to a point where, when you look back, you will be surprised at how far you’ve progressed.

9. Know your needs and wants

Do you know your needs? Can you differentiate them from your wants? You can only get the right priorities when you know that your needs are the most vital things for you to survive, and that your wants are just additional things you need for luxury and pleasure.

For instance, you need clothes to wear, a house to sleep in and food to eat. You can’t do without these things. Also, you want a car, a television and/or a well-furnished mansion. But on the other hand, you can do without these wants.

However, one of the things you will get to prioritize if you have the right money mindset is to invest your money in order to make more money, not necessarily spending on luxury when you have no investment in place.

For You

To conclude, it is of high importance to point out that the major driving force that enables the rich to attain such a high level of wealth is their money mindset.

This is in line with what idealism projects: that for anything to manifest physically, it has already been processed in the mind. In other words, before you become rich, you already have the mindset to become rich. It is now left to you to adopt the right money mindset as discussed above and unlock the financial freedom that you yearn for!

Psst – If you’re really SERIOUS about transforming your money mindset – meditation and the proper affirmations can go a long way towards helping you achieve this. There’s a program called Overnight Millionaire which I highly recommend. It helps you reprogram your brain from scarcity to abundance and helps you manifest more wealth into your life. But only if you let it and actually do the required work. Check it out if you’re interested.

You might also want to read about:

- 10 Tips On How To Have An Abundance Mindset

- How To Develop A Positive Mindset: 12 Real Tips

- 15 Morning Routine Habits For A Productive Day

Don’t forget to pin these 9 tips on ways to transform your money mindset!